Big Data Analytics pays off, new research shows

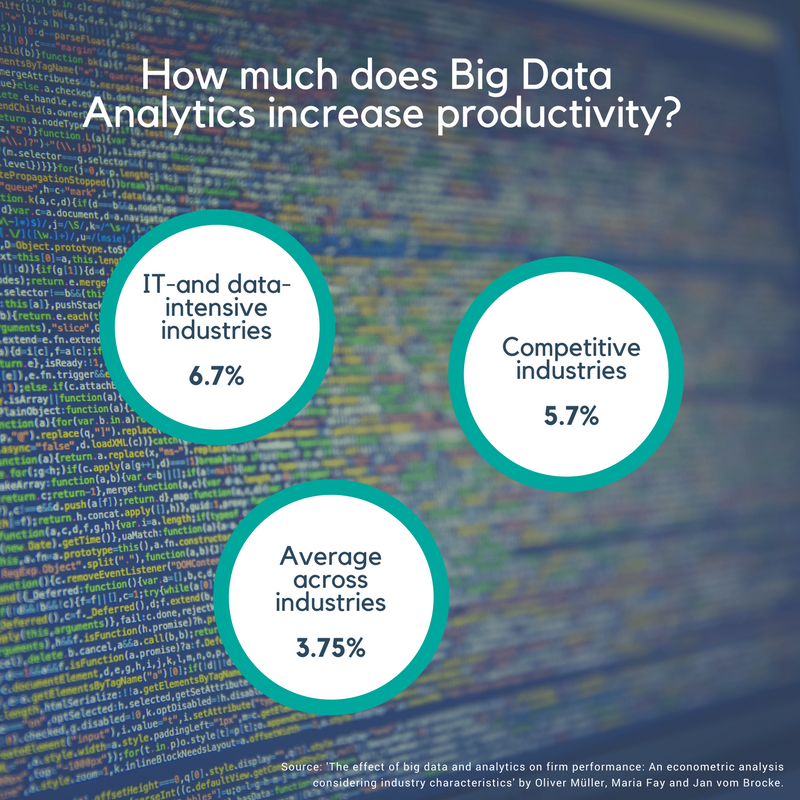

On average, companies can increase productivity by 3.75 percent by implementing Big Data Analytics solutions, shows research from the IT University of Copenhagen and the University of Liechtenstein. Their study is based on data from more than 800 major companies.

Business IT DepartmentResearchbig databusinessOliver Müller

Written 4 April, 2018 08:41 by Vibeke Arildsen

Over the past decade, many companies have started using of Big Data Analytics (BDA) to optimize their business. For large enterprises, this can easily entail investments of several tens of millions of dollars for purchasing new hardware and software, hiring data-savvy employees, and integrating the new software with existing systems and processes.

Oliver Müller, Associate Professor at ITU, is one of the three researchers behind the study. Researchers from the IT University of Copenhagen and the University of Liechtenstein have investigated whether these enormous investments pay off.

Oliver Müller, Associate Professor at ITU, is one of the three researchers behind the study. Researchers from the IT University of Copenhagen and the University of Liechtenstein have investigated whether these enormous investments pay off.

The researchers have analysed data from one of the world’s largest software vendors about the implementation of big data solutions in more than 800 major companies between 2008 and 2014. Their analysis is one of the first academic studies of the correlation between use of big data solutions and firm performance.

IT-intensive companies benefit the most

On average across all industries, BDA increased productivity by 3.75 percent. However, there are variations between industries, says Oliver Müller, Associate Professor at the IT University and principal investigator of the project.

Companies in IT- and data-intensive industries clearly benefit from using Big Data Analytics.

Oliver Müller, Associate Professor at ITU

"Companies in IT- and data-intensive industries clearly benefit from using Big Data Analytics. These companies can increase productivity by almost 7 percent on average per year compared to similar companies that do not use big data solutions," he says.

According to Oliver Müller, the most likely explanation is that IT- and data-intensive companies have the required infrastructure in place to feed the big data solutions with data. In addition, they have employees with the right skillset to exploit the potential of the data, such as data scientists.

"This finding shows that big data solutions cannot stand alone. It is important that companies also have complementary systems and employees available," he says.

Robust empirical evidence

In highly competitive industries such as retail, banking and telecommunications, BDA can also make a difference on the bottom line.

"In industries where many companies offer similar products or services, big data solutions can make the difference. We found productivity improvements of almost 6 percent here. These companies are probably better at exploiting the big data solutions than companies in less competitive industries," says Oliver Müller.

"Taken together, our findings provide robust empirical evidence that BDA does generate business value, but also highlight the importance of considering the conditions in your specific industry before investing. Our results can help decision makers to manage expectations regarding how large the return on investment of BDA will be and how long it takes until the benefits will outweigh the initial costs,” says Oliver Müller.

Oliver Müller, Associate Professor, email olmy@itu.dk

Vibeke Arildsen, Press Officer, phone 2555 0447, email viar@itu.dk